1- Understanding Identity Theft

Identity theft is defined as the act of impersonating someone else using your personal information. This can include information such as your name, date of birth, address, social security number, credit card information, and more. Fraudsters can use this information to commit fraudulent or even criminal acts, make online purchases, or misuse your health data. The consequences can be severe, so it’s important to take precautions to protect yourself.

- The Role of a Private Detective in Identity Theft Cases

A private detective can help identity theft victims by investigating the identity of the perpetrator. A private detective can gather information about the offender, such as their name, address, or phone number. This information can then be used as evidence in court.

A private detective can also assist victims in protecting their identity by providing advice on measures to prevent future identity theft. For example, a private detective may recommend the installation of additional security systems to safeguard the individual’s personal information.

- How Does Identity Theft Occur?

Identity theft can occur in several ways, including through computer hacking, wallet theft, or email phishing campaigns. Hackers can use malicious software to steal personal information from your computer or smartphone. Wallet thieves can steal your credit cards or driver’s license, which contain the necessary information for committing offenses in your name. Fraudsters may also attempt to deceive you using emails or phone calls to obtain your personal information.

- Common Types of Identity Theft

There are several types of identity theft, each with different consequences. Here are some examples:

4.1 Bank Identity Theft

Bank identity theft occurs when an individual uses your personal information to open bank accounts, obtain credit cards, or take out loans in your name. Fraudsters may also use your information to make online purchases or transfer money from your bank account.

4.2 Identity Theft for Criminal Purposes

Identity theft for criminal purposes occurs when someone uses your personal information to commit crimes. Fraudsters may use your identity to obtain a driver’s license, ID card, or passport in your name.

4.3 Medical Identity Theft

Medical identity theft occurs when someone uses your personal information to obtain prescriptions, medical care, and even undergo surgery under your name.

- How to Protect Against Identity Theft

There are several precautions you can take to protect yourself against identity theft. Here are some of the most common measures:

5.1 Shred Sensitive Documents

Documents containing personal information such as your name, address, or social security number should be shredded before disposal. Fraudsters may search through garbage for documents containing personal information.

5.2 Monitor Your Bank Accounts

It’s important to regularly monitor your bank accounts to detect any fraudulent activity. In case of suspicious transactions, it is recommended to immediately contact your bank to initiate necessary actions.

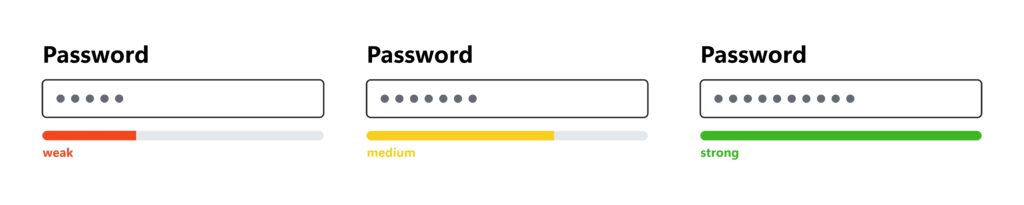

5.3 Use Strong Passwords

Use strong passwords for all your online accounts. Passwords should be long and complex, including letters, numbers, and symbols.

5.4 Use Two-Factor Authentication

Two-factor authentication is an additional security measure that adds an extra layer of protection to your online accounts. In addition to your password, two-factor authentication requires you to provide a second form of identification, such as a code sent via SMS to your mobile phone.

5.5 Be Cautious on Social Media

Social media platforms are a goldmine of personal information for fraudsters. Avoid sharing sensitive information on social media, such as your date of birth, address, or phone number.

5.6 Beware of Malicious Emails and Phone Calls

Fraudsters may pose as representatives of banks or other financial institutions to obtain your personal information. Beware of unsolicited emails and phone calls, and never disclose your personal information unless you are sure of the person’s identity.

Conclusion

The assistance of a competent private detective can be invaluable in identifying an offender and protecting the victim’s identity, as identity theft can cause significant financial and emotional damage.

By taking simple measures to protect your personal information, you can significantly reduce the risk of identity theft. Remember to shred sensitive documents, monitor your bank accounts, use strong passwords, employ two-factor authentication, be cautious on social media, and be wary of malicious emails and phone calls.

By following these precautions, you can greatly reduce the risk of identity theft. Keep in mind that protecting your personal information is important for your financial and personal security.